2024

Instant Economy Payment Insights

Discover the Latest Trends in Online Payments

As digital devices and fast payments become more common, the way we pay online is changing. An instant revolution is gathering speed.

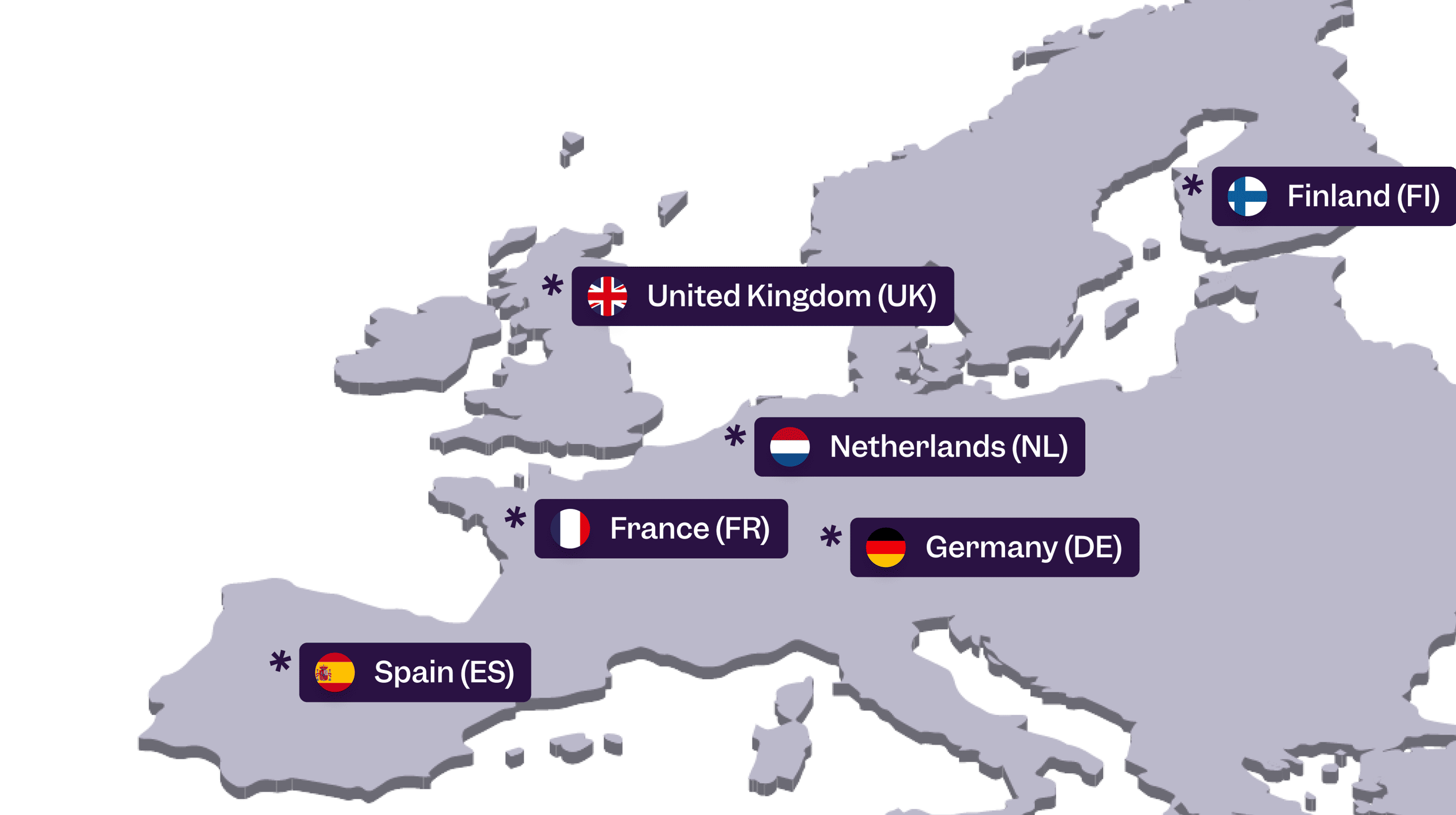

Brite commissioned YouGov to survey over 8000 consumers across six key European markets, analysing the landscape of online payments.

For a deep dive into how online payments are evolving and to understand the driving forces behind consumer choices in 2024, download Brite’s Instant Economy Payment Insights report now to learn:

- Preferred online payment methods within markets

- Why consumers select specific online payment methods

- What consumers want from new payment methods

- Why now is the time to offer Pay by Bank in your checkout

- Plus, much more…

Online Payment Insights

For Six Key Markets

From conversion challenges to familiarity with different payments, this report contains insights into

why consumers select payment methods within the instant economy.

Key Findings: Pay by Bank

Understanding Payment Choices in The Instant Economy

Online payments are evolving more rapidly than ever. Our report reveals not only the most popular online payment methods but also how digital wallets and Pay by Bank (which includes instant account-to-account payments) are becoming the preferred choice for a younger, digital-savvy generation. With payment insights into the adoption rates in different countries and analysis of the driving forces behind these preferences, we uncover a future where traditional methods like credit cards may no longer hold the reins.

Consumer Perspectives on Payment Methods

Diving into the heart of consumer preferences in the instant economy, our findings show clear generational divides. For example, 36% of young adults aged 18-29 are embracing Pay by Bank for its speed and security – significantly higher than any other age group. Additionally, we explore different perspectives across demographics to different payment methods, highlighting how and why the tide is turning towards more innovative solutions. From the allure of instant transactions to brand trust and bank-level security, we try to understand the factors shaping the future of purchases online.

Trends, Preferences, and Pay by Bank Prospects

The future of Pay by Bank (and account-to-account payments, or A2A payments) looks promising, with a reported 73% of consumers across key markets familiar with it as an online payment method, and even greater familiarity in countries such as the Netherlands and Spain. Moreover, going deeper into our analysis we present how Pay by Bank is set to redefine online payments in the instant economy. But what are consumer expectations in terms of how long a payment should take in the instant economy? What are the factors behind consumers being willing to pay using different methods? And what makes Pay by Bank such an attractive online payment method for consumers across all our surveyed markets?

Download Instant Economy Payment Insights: 2024

Evolving Preferences and the Rise of Pay by Bank

Get more insights into payments and the Instant Economy

Brite Minds: Navigating Online Payments in the Instant Economy

Navigating online payments is essential for businesses in the instant economy. With

Why Now is the Time to Add A2A Payments (Pay by Bank) to Your Checkout

Across Europe, there is a rising demand for frictionless and secure online

Security and fraud prevention in instant transactions

Fraud prevention within online payments is essential. Today, virtually every consumer on

Payment Technologies in the Instant Economy

Payment technologies and new payment methods are helping to shape consumer payments

Essential Consumer Trends in the Instant Economy 2024

Customer loyalty is facing a squeeze, with every industry from financial services

Is 2024 Pay by Bank’s Big Moment?

Pay by Bank is rapidly becoming an integral part of the instant

In the Age of Instant – It’s Time for Payments to Step Up

Immediacy and convenience are at the core of today’s instant economy, with